Measuring Climate and Environmental Risks in the Financial Sector

Video: climate risks

TABLE OF CONTENTS

COMPLETE DOCUMENT

In recent decades, the effects of climate change and environmental degradation have become a major concern for many economies around the world. This has led governments and businesses to reassess their impacts and consider their implications across all sectors.

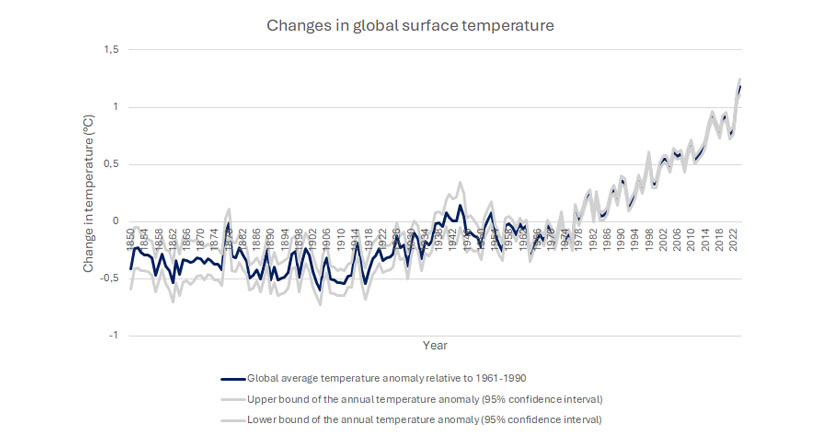

The Intergovernmental Panel on Climate Change (IPCC) has highlighted the tangible effects of rising global temperatures on climatic phenomena. According to the IPCC's 2023 Synthesis Report , human activities, especially greenhouse gas emissions, are clearly the main driver of climate change, with far-reaching impacts already being observed in all regions of the planet. Global surface temperatures have risen by about 1.2°C compared to pre-industrial levels, with significant impacts on weather phenomena and climate extremes. This warming is causing irreversible changes in ecosystems, sea levels and weather patterns, and these effects are expected to intensify if emissions continue to rise.

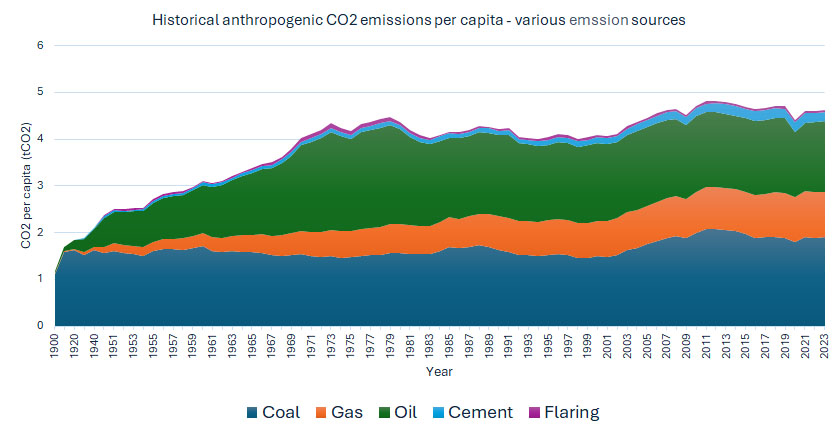

Economic development based on highly carbon-dependent production models in many economic sectors is increasing greenhouse gas emissions into the atmosphere.

|

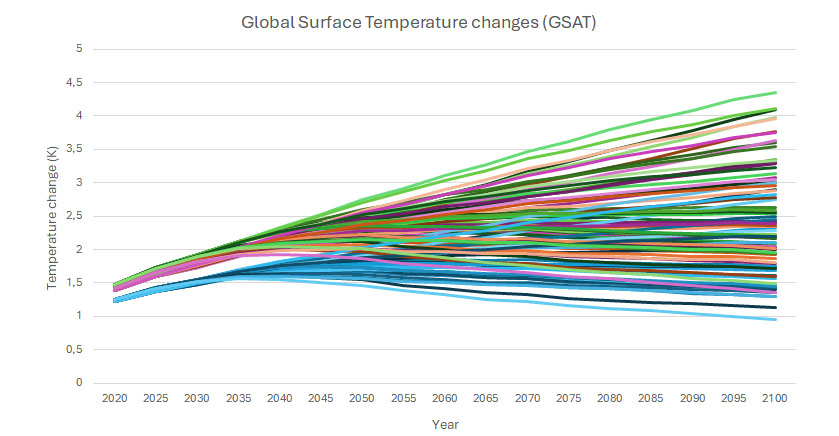

As a result, global temperatures are projected to rise by as much as 1.5°C above pre-industrial levels by 2030 under some scenarios.

|

This increase could reach 1.5°C above pre-industrial levels as early as 2030. In some scenarios, levels of 2.5°C could be reached by 2050.

|

This temperature trend will lead to medium- and long-term changes in climate behavior, as well as an increase in the frequency and severity of extreme weather events, creating so-called "physical climate risks" for economic actors, which may vary by sector and region:

"Economic damages from climate change have been identified in climate-exposed sectors, with regional impacts on agriculture, forestry, fisheries, energy, and tourism, as well as through outdoor labor productivity. Some extreme weather events, such as tropical cyclones, have reduced short-term economic growth". IPCC: AR6 Climate Change (2022).

With regard to environmental risks, according to the FSB's Task Force on Nature-Related Financial Disclosures (TNFD), "science has shown that nature is deteriorating on a global scale and that biodiversity is declining faster than at any time in human history". As a result, nature-related risks have risen to the top of the global political agenda.

These include, but are not limited to, the following examples: (i) Critical supply chains, such as agriculture or semiconductors, face disruptions due to water shortages or water stress; (ii) Loss of pollinators negatively impacts agricultural production, while demand for pollinators is increasing in some countries; (iii) Forest degradation threatens the long-term viability of the products on which some sectors depend.

In fact, central banks and financial institutions are increasingly recognizing that the degradation of nature is a source of systemic risk to the financial system and economies.

In this context, productive sectors and household economies can be transformed to mitigate or adapt to climate change and environmental degradation. However, the transition to a decarbonized productive system that also protects (or at least does not damage) the environment implies a drastic transformation of the global economy through major regulatory, market or technological changes, which also entails significant risks for economic agents, giving rise to the so-called "transition risks", which can affect economic stability.

Faced with this reality, governments are beginning to take political and fiscal measures to prevent and mitigate the negative impacts of human activities on climate and nature. Numerous international organizations have been created and are working to establish criteria and principles for measurement, performance and disclosure of information by economic actors . In December 2015, the FSB established the Task Force on Climate-related Financial Disclosures (TCFD), which aimed to identify the information needed by investors, lenders and insurers to measure and assess the risks and opportunities associated with climate change.

Regarding the environment, the Task Force on Nature-Related Financial Disclosures (TNFD) was launched in June 2021 and received global endorsement from the G7 and G20. Its goal is to develop a disclosure framework for all organizations of different sizes, sectors and jurisdictions so that better quality environmental information can be made available to corporate and capital market decision-makers through reports in order to improve corporate and portfolio risk management.

In addition, the International Sustainability Standards Board (ISSB) was established in November 2021 and published Sustainability Disclosure Standards (IFRS S1 and S2) in June 2023, endorsing the TCFD principles, which require companies to quantify and disclose their climate-related risks, as well as information on the strategy, governance and management of these risks, and to set metrics and targets.

Finally, the European Union's Corporate Sustainability Reporting Directive (CSRD) establishes a stricter regulatory framework for companies to disclose information on their environmental, social and governance (ESG) impacts. From December 2024, companies subject to this regulation will be required to provide detailed reports on their sustainability-related risks and opportunities, as well as their performance in terms of strategy, governance and sustainability metrics, in line with European and international standards to improve transparency and comparability of information.

With regard to the financial sector, and given its systemic importance in the global economy, eight central banks and supervisors established the Network for the Greening of the Financial Sector (NGFS) in December 2017. The NGFS now includes 134 central banks and supervisors, and aims to contribute to the development of environmental and climate risk management in the financial sector and to mobilize mainstream finance to support the transition to a sustainable economy . In April 2019, the NGFS recommended the adoption of the TCFD principles: “NGFS members collectively commit to support the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). The NGFS encourages all companies issuing debt or equity, as well as financial sector institutions, to disclose in line with the TCFD recommendations.”

The financial sector: at the center of turbulence

The financial sector is directly exposed to climate and environmental (C&E) risks through the positions it holds with its counterparties: these risks not only jeopardize the operational and financial performance of companies, but are also transmitted to the financial sector, as they can affect asset valuations and investment returns through the transmission channels (see graph in Figure 3), thus amplifying systemic risks across global financial markets.

The effects of climate risks

Climate risks can affect all the traditional categories of risk to which financial institutions are exposed , including credit, market, operational, business, liquidity and reputational risks.

Physical risks, such as floods, wildfires or storms, directly affect companies' assets and operations, as they can disrupt production processes, damage assets and entail significant repair and recovery costs. This can lead to a change in the productive capacity of companies and deteriorate cash flows and profitability, increasing the probability of default for borrowers highly exposed to such risks. In addition, the value of assets that serve as collateral for credit loans may be reduced, further jeopardizing credit facilities.

On the other hand, companies that do not adapt their production models to a decarbonized economy may experience a gradual erosion of their competitive position and market share, an increase in stranded assets or asset devaluation, especially in carbon-intensive sectors. This translates into reduced revenues and an increased risk of credit downgrade or default, creating significant credit risks for financial institutions.

In addition, not only the credit portfolio position, but also the valuation of financial instruments can be directly affected by climate risks. Equity and debt instruments of companies with high climate risk exposure may experience a change in their market value as investors recalibrate their expectations in light of emerging risks and opportunities. This repricing process can lead to increased volatility in financial markets and result in significant losses for investors and entities holding these instruments. Fixed income instruments are susceptible to weather-related credit rating adjustments, which can affect their performance and market value. As market participants increasingly incorporate climate risk assessments into their investment decisions, the price of securities will reflect the increased perception of risk, which could lead to larger adjustments.

The impact of environmental risks

As with climate risks, the link between nature-related financial risks (biodiversity loss and ecosystem degradation) and financial institutions is through specific transmission channels.

Both climate and environmental risks can also be amplified if insurance companies deem these risks in certain geographies or sectors too high to underwrite, thereby reducing their exposure or significantly increasing premiums, which could leave households and businesses uncovered, thus increasing systemic effects.

There is therefore an urgent need to develop methodologies for measuring these risks in financial institutions and insurance companies. Such measurement poses several challenges and complexities for the financial sector, stemming mainly from the uncertainty inherent in the impacts of climate change and environmental degradation, the lack of standardized metrics, the difficulty of integrating these risks into existing financial models, and the availability and quality of information:

• • First, the uncertain and long-term nature of climate change and the slow (but inexorable) pace of environmental degradation undermine the effectiveness of traditional risk assessment models, which rely heavily on historical data. C&E risks are characterized by the fact that they materialize over a long-term time horizon. Therefore, scenario analysis and stress testing, which can consider different future scenarios (rather than relying solely on historical data), become key analytical tools.

• • Second, the lack of standardized metrics and definitions for C&E risks makes them difficult to measure and compare across industries and geographies. Although initiatives such as the TCFD or TNFD have made significant progress in encouraging the disclosure of C&E-related financial information, the variability in reporting practices and the qualitative nature of much of this information limit its usefulness for risk assessment. This lack of standardization hampers the ability of financial institutions to conduct comprehensive analyses and systematically compare risks in their portfolios.

• Third, C&E risks require innovative modeling techniques that can incorporate future climate scenarios and their potential economic impacts. However, the development of such forward-looking models requires a sophisticated understanding of climate science and its interaction with economic variables, a skill that is still evolving within the financial sector.

• Finally, data availability and quality are additional hurdles. Accurate risk assessment depends on access to reliable, granular and relevant data on physical and transient risks associated with climate change and environmental degradation, which can be highly region-specific. However, the lack of granularity and accuracy of climate and environmental data (e.g., geolocated projections of climate impacts, information on emissions from specific industries, status and evolution of ecosystems, geolocation of companies' productive assets, etc.) hampers the ability of financial institutions to conduct accurate risk assessments. Initiatives to improve the quality and accessibility of individual and sectoral climate data are crucial to making progress in measuring such risks.

Moreover, integrating C&E risks into the financial decision-making process is crucial for two main reasons: (i) it allows institutions to make more informed lending, investment and insurance underwriting decisions, thereby increasing their own resilience to C&E-related risks; and (ii) by accurately measuring and pricing these risks, financial institutions can allocate capital more efficiently, directing funds toward projects and companies that are not only less susceptible to them, but also contribute to the transition to a low-carbon, environmentally friendly economy.

This integration is not without its challenges. Financial institutions face the complex task of integrating these risks into their current risk management frameworks, which were not originally designed to accommodate the multifaceted nature of C&E risks. This integration requires not only the development of new tools and metrics, but also a cultural shift within organizations to recognize the importance of C&E risks and prioritize their management.

In summary, the adoption of sound measurement methodologies by the financial sector is not only a regulatory requirement, but also a strategic imperative. It provides the basis for developing innovative financial products, such as green bonds and sustainability-linked loans, that can incentivize and support the transition to a sustainable economy. Furthermore, by accurately assessing and managing C&E risks, financial institutions can protect themselves against the reputational, operational and financial risks associated with climate change and environmental degradation, while playing a key role in mobilizing the investments needed to mitigate their effects.

In this context, this study aims to provide a perspective on the different methodologies for measuring climate and environmental risks, focusing on the financial and insurance sector. To this end, the paper is structured in four sections, which aim to: (i) summarise the supervisory requirements in relation to the measurement of C&E risks; (ii) discuss different quantitative approaches that can be applied to the measurement of physical and transitional climate risks, depending on the nature of the portfolios; (iii) propose approaches to address the quantification of environmental risks; and (iv) show the application of the described methodology through a case study of the measurement of the impacts of transitional climate risks on a corporate bond portfolio.

Table of Contents

Environmental risks

Illustrative example

Conclusions

Glossary & references

Measuring Climate and Environmental Risks in the Financial Sector

Access the full document