Why PALADIN 2.0?

Paladin 2.0 arises as a response to the need of the entities to have an end-to-end system for the prevention of money laundering and terrorist financing, focusing on the integral management of alerts and files, regulatory and management reporting, allowing a transparent integration with analytical and statistical engines

The new version of Paladin is an upgrade to Management Solutions' previous anti-money laundering and counter-terrorist financing (AML/CFT) technology solution.

With a design based on industry best practices, Paladin 2.0 offers end users a wide range of benefits through its intuitive interface and customizable modules.

Main features of Paladin 2.0:

- • Enables comprehensive management of the AML/CFT function of financial institutions (monitoring, alert analysis, regulatory reporting, internal reporting, etc.) independent of analytical and statistical engines, facilitating independence between the technological layer (IT) and the management layer, and preserving business processes.

- • End-to-end solution that integrates all the information needed to analyze alerts and files, including information on customers, products, transactions, politically exposed persons (PEPs), sanctions, negative news, etc.

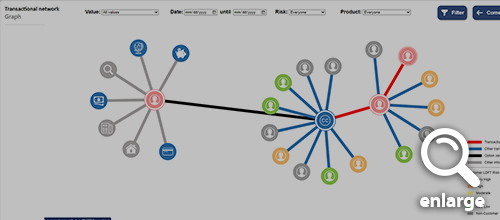

- • Interactive visualization of the transaction network through graphs, facilitating the analysis of the "money trail" and the traceability of suspicious customers..

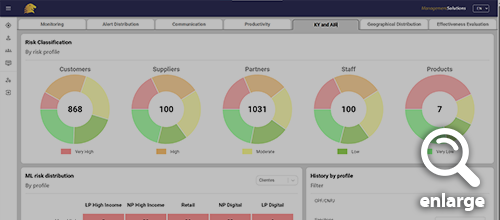

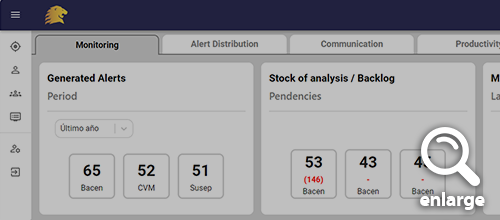

- • Easy visualization of dashboards and indicators, making available different visions - executive, management and operational -, allowing for access under different hierarchies for more accurate and timely decisions.

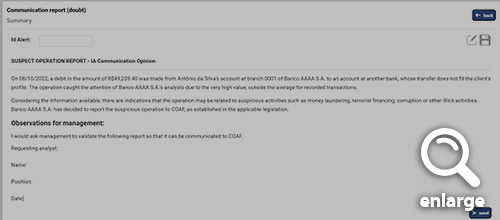

- • Integration of artificial intelligence (AI) components throughout the alert management and regulatory reporting process, such as preparation of regulatory dossiers, risk scoring, etc.

- • Flexibility in module customization, allowing Paladin 2.0 to best fit the organization's AML/CFT management process.

- • Flexibility to integrate with market solutions and in-house developments such as alert engines, scoring/risk models, etc.

Benefits

Paladin 2.0 meets the functional and technological AML needs of institutions by being segmented into decoupled modules that adapt to existing AML processes without requiring long and complicated customization and internal transformation processes

User benefits

Information Technology (IT) benefits

Paladin features

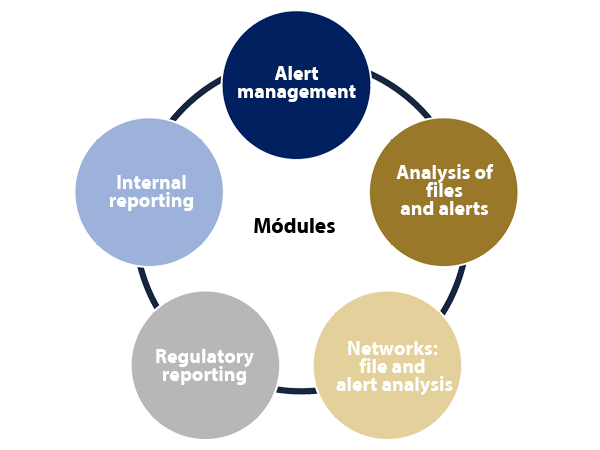

Functional integration of the various Paladin 2.0 modules allows comprehensive and efficient management of the AML/FT function

Paladin 2.0 integrates in a single work environment 5 modules to globally manage the AML/FT function:

• Alert management.

• Analysis of files and alerts.

• Networks: file and alert analysis.

• Regulatory reporting.

• Internal reporting.

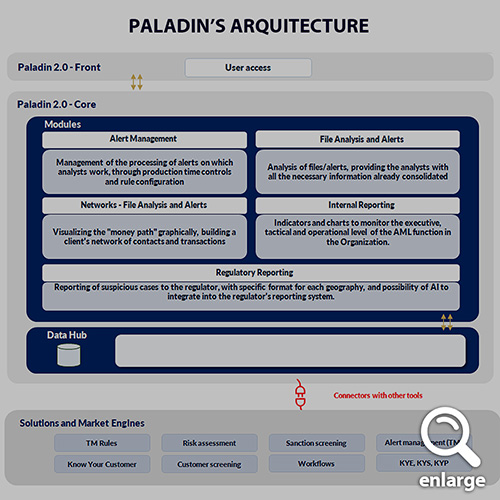

Technical architecture

Paladin 2.0 allows the customization of its modules in an agile way, facilitating the integration with the solutions and engines already implemented in the organization

Paladin 2.0 architecture contemplates the intelligence of the 5 modules, presented in a friendly front-end and adaptable to the user's needs, allowing the customization of its modules in an agile way. The solution is powered by a data hub, facilitating integration with the solutions and engines already implemented in the entity to have a solution that allows end-to-end management of AML (transactional monitoring, Know Your Customer -KYC-, Know Your Employee -KYE-, Know Your Partner -KYP-, Know Your Supplier -KYS-, risk assessment, sanctions, etc.).

CREDENTIALS

With Paladin 2.0, financial institutions guarantee reliability and security for the supervisions imposed by the main regulators of each country and by external audits for the prevention of money laundering

Paladin 2.0 has been developed to serve all industries, regulated or not, that wish to have a model for the prevention and control of money laundering and terrorist financing in their entities.

National and international financial and insurance groups

Large, medium and small commercial banks

Credit unions

Remittance entities

Management Solutions is an international consulting services firm focused on business, risk, finance, organization and process consulting, both in its functional components and in the implementation of related technologies.

Management Solutions currently has a multidisciplinary team of professionals (functional, mathematical, technical, and systems integration) of approximately 4,000 professionals working through 48 offices from where we provide recurring services to clients operating in more than 50 countries from five continents (Europe, America, Asia, Africa and Oceania).

Management Solutions' differentiation lies in our in-depth knowledge of the businesses in which our clients operate and our high level of industry and functional specialization.

For more information please visit: www.managementsolutions.comFor more information

Rodolfo ArévaloPartner at Management Solutions

rodolfo.arevalo@msbrazil.com

José Ángel Aragón Lorenzo

Partner at Management Solutions

jose.angel.aragon@managementsolutions.com